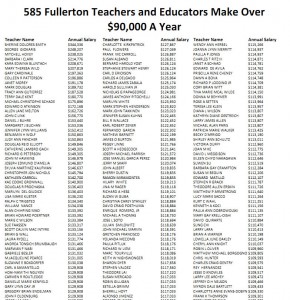

We fielded all sorts of bitter accusations from teachers when FFFF handed out our list of teacher and administrator pay at this week’s teacher rallies. Responses ranged from the simple “the list is garbage” and “my brother does not make that kind of money” all the way to “the District distorted the figures because they’re against us.”

Yes, we explained that the numbers came straight from district HQ (Here are details, in case you’ve missed it: FJUHSD Salaries over $90,000 and FSD Salaries over $90,000.) But some of the chanting unioneers could not be swayed.

Teachers of the list, here is your challenge:

Show us your pay stubs from the 2009-2010 school year! If you can prove that your salary was overstated in our flier, we’ll go back to district HQ and take them to task on your behalf.

Otherwise, we’ll just go with what we already know: this list is 100% true and correct.