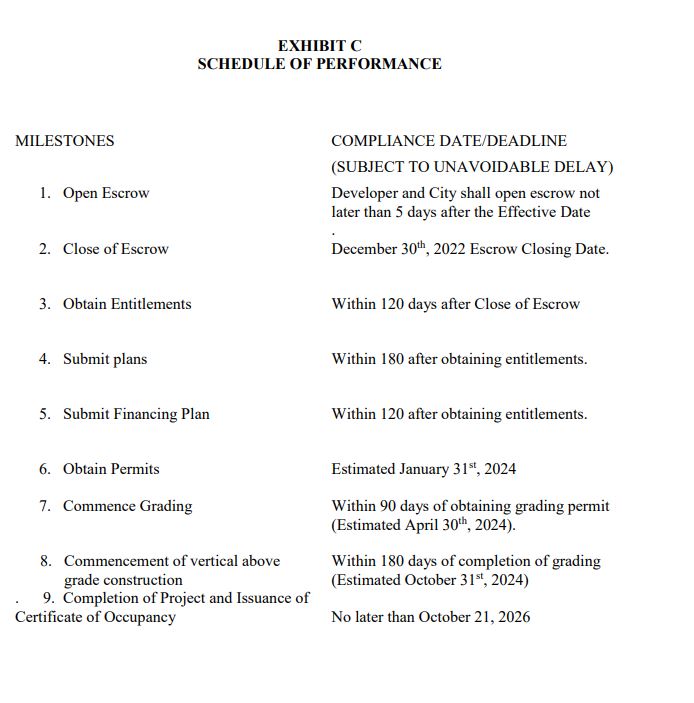

And last year we were number 29, among Orange County’s 34 cities based on per capita unrestricted net positions (UNP).

FFFF’s Bureau of Data & Statistics (FFFFBDS) was presented the following chart produced by the California Policy Center, a conservative think tank who tracks such things.

Ouch. Fullerton is way down there at the bottom – each citizen being in the red for $1050 – based on 2023 numbers from the Annual Comprehensive Financial Report. We are better off than Orange, Costa Mesa, Anaheim and Santa Ana.

Pretty soon Fullerton is going to have to pay the piper and we will be presented, once again, with a Measure S-type sales tax increase in the 13% range. The question is whether such a tax can pass at an election. A General Tax only needs 50%+1 but may be a tough sell; a special tax – for infrastructure, say – requires 67% a harder nut, but one where people can see what they’re getting.

An infrastructures tax does noting to alleviate Fullerton’s chronic financial mismanagement under Fitzgerald, Flory, Zahra, Quirk-Silva and Charles. It’s very clear that the liberals on the Council want the tax that eluded them in 2020.

But what about Jung and Dunlap? They are no longer able to distance themselves from Fullerton’s fiscal cliff having now been around for over four years. What have they done to ameliorate the chronic shortfall? The answer is nothing. For years the sleepy Bruce Whitaker voted no on annual budgets and he never bothered to put much thought into solving the problem.

Then there’s newcomer Jamie Valencia who’s not responsible for any part of the problem – yet. Will she go for a tax on the ballot? Her public safety union supporters will push her. Does she even understand the magnitude of Fullerton’s mismanagement? I wonder.

Of course we may be grateful that Valencia’s opponent didn’t win. Then a sales tax would have been inevitable.