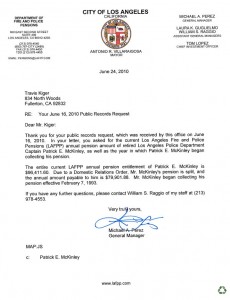

The other day we challenged retired police chief and $215,000 public pensioner Pat McKinley to put some real meat behind his dubious claim that he will “work to reform public employee pensions.”

Over the weekend we discovered a letter posted to McKinley’s website purporting to declare his position on pension reform. Exciting… until we read it. The letter actually commits to nothing and woefully understates the changes necessary to even begin correcting this problem.

Let’s run through Pat’s suggestions one by one. It’s important to note that McKinley’s letter says pension reform must contain ONLY ONE of the following:

Increase the amount contributed to the plan by Employee Contributions – Necessary, but wholly insufficient. While giving taxpayers some breathing room, demanding employees pay a little bit more does nothing to address the core issue, which is the unsustainable nature of pension guarantees when combined with the power of public employee union lobby. By itself, this change only slightly delays the pain.

Increase the amount contributed to the plan by Employer Contributions – Unbelievable. Increasing employer contributions is another way of saying we should raising taxes to pay for pensions. So now it would be safe to say that Pat McKinley wants to raise your taxes, but it’s really hard to believe he would write anything this dumb. For now, we’ll just assume that he has no idea what he’s talking about.

Slow the accrual of pension benefits by returning the formula to its previous level – Legally a change like this change can only be made for new employees, which would do nothing to address the massive unfunded liability that we have already accrued. Furthermore, it leaves the door wide open for future abuse when the unions become more powerful.

Slow the accrual of pension benefits by increasing the normal retirement age to reflect the longer life expectancies of our City employees – Same problem as above. The commitments we’ve made to current employees cannot be changed without a bankruptcy. The only lever we really have left salary and to a lesser extent, contributions. Cut salaries, raise employee contributions… or go broke.

Slow the payout of retirement benefits by lowering the Cost of Living Adjustment in retirement – The cost of living adjustment is about 2% a year. Reducing that, if it’s even legal in California, is hardly enough to sustain hundreds of public safety employee’s earning 90% of their final year’s pay for the next 30 years. And once again, there’s nothing to prevent another band of RINO’s from reinstating this benefit the next time CalPERS overstates its assets.

So what have we learned? McKinley has thrown out a bunch of half baked ideas to fool you into thinking that he wants pension reform, but it really boils down to almost nothing useful. And of course, even after writing this letter, McKinley has not committed to any pension reform.

We’ll say it again: Taxpayer-funded defined benefit plans must come to an end. The private sector learned long ago that they are completely unsustainable and also unnecessary. All new employees should be given defined contribution plans, while current employees should be made to pay as much as possible towards their own retirement, in order to mitigate the damage caused by their own unions and CalPERS through deception and poor planning.