Here’s a fun repeat-post from last spring – featuring two of 4SD Observer’s favorite idols: emergency service providers and the dim-witted Pam Keller. For sheer fat-headedness, selfishness, and fiscal irresponsibility, you just can’t beat the ESP union.

– Joe Sipowicz

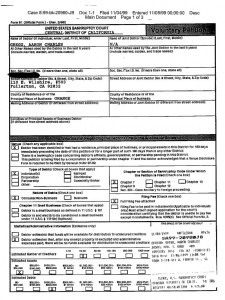

Pam Keller was the only city council member who did not have the guts to impose a %5 pay reduction on members of the Fullerton firefighter’s union after negotiations failed on Tuesday. The union refused to accept a deal similar to those offered to all other Fullerton employees.

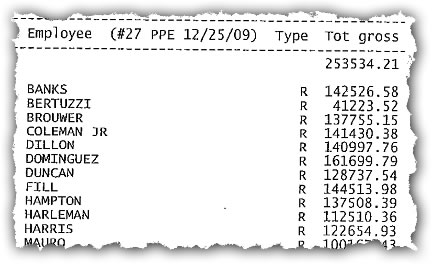

The union says the pay cut is unfair. Is that true? Let’s see what firefighters actually took home last year:

View the 2009 Fullerton Fire Dept payroll

View the 2009 Fullerton Fire Dept payroll

In addition to the gross pay numbers above, firefighters receive the following estimated benefits at the city’s expense:

Pension contribution: ~30% of base salary. Ranges from $15,000 to 28,000/yr, not including unfunded liabilities

Medical: $5,460 to $14,748/yr

Dental: $588 to $1,128/yr

Not a bad gig. It’s no wonder there are hundreds of applicants whenever a position opens up.

Does Keller really think that asking this highly compensated group of public employees to take the same pay cut as everyone else was “unfair?’

Or perhaps Pam is just sticking to what Pam does best: Helping folks suck as much as possible out of the public trough. By any means, at any cost.